Apple Card is now available for qualifying customers in the US starting now. After a brief early-access period offered to select customers and Apple employees, the new digital credit card is now available for iPhone users all over the US.

Apple’s new credit card lives in the Wallet app on your iPhone and is connected to Apple Pay. It’s a Goldman Sachs-backed Mastercard that can be used and managed on any iPhone running iOS 12.4 or newer. However, you have to opt out of their arbitration clause if you want to keep the right to sue.

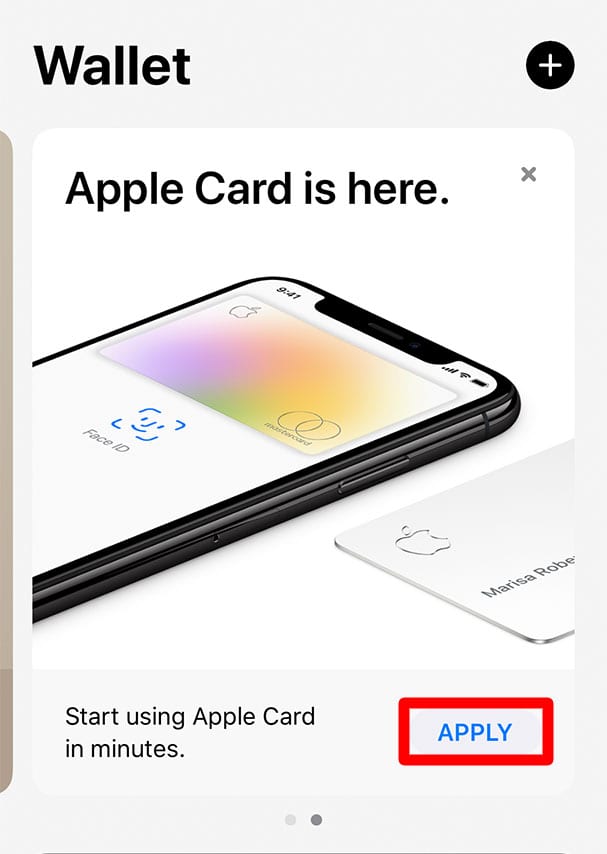

How to Apply for an Apple Card

If you have an iPhone 6 and higher, you’re 18 years of age or older, and you’re a resident of the United States, applying for an Apple Card is a straightforward process.

- Launch the Wallet app and go to the Apple Card interface.

- You will be asked to enter your name, date of birth, phone number, address, the last 4 digits of your social security number, and your citizenship. Most of the information will be pulled from your Apple ID details.

- You will then be asked to disclose your annual income and provide a photo of your driver’s license or state ID.

Just like applying for other credit cards, your application is subject to approval. Your credit limit will also depend on your annual income and other determining factors. A credit check will be conducted by Goldman Sachs before your application is approved.

How to Use the Apple Card

You can use your Apple Card for in-store purchases on an iPhone and for shopping on other Apple devices. For security, two-factor authentication is automatically turned on. You will also need to be signed in to iCloud on your device when you pay for purchases using your Apple Card.

When paying for non-Apple products, the physical Apple Card will be required. This card will be shipped to you after you open an account. The card is valid wherever MasterCard is accepted.

Apple Card Benefits

Apple Card promises to make your spending habits easier to understand. Here are some of the benefits of using Apple Card.

- There are no annual, late, international, or over-the-limit fees.

- There’s a range of payment options, with calculated interest costs for each.

- There are weekly spending summaries that have transactions, including merchant names and locations

- The physical card is free, and there’s no fee for replacing it

Additionally, Apple Card also comes with a Daily Cash rewards program where customers will receive 3% Daily Cash on Apple purchases. That includes anything you buy from Apple, the App Store, or iTunes.

Customers will also get 2% Daily Cash every time they use Apple Card at a store that takes Apple Pay.

For stores that don’t take Apple Pay, customers will receive a 1% Daily Cash. Merchants are currently being added to the rewards program. As of now, customers can also enjoy 3% Daily Cash on Uber and Uber Eats.

How to Opt Out of the Apple Card Arbitration Clause

While these rewards and features seem promising, it is essential that you are aware of the arbitration clause that you enter into with Goldman Sachs when you apply for an Apple Card.

An arbitration clause, for the most part, prevents you from participating in a class-action suit against the company. It also denies you the right to sue the company as an individual. Instead, an arbitrator will be chosen by the company to oversee the case and make a ruling that cannot be appealed.

You can choose to opt out of the arbitration clause when you sign up for an Apple Card, but you have to do it within 90 days after you open an account.

In order to opt out of the arbitration clause, you have to send a written statement to Apple that says you are “exercising your right to reject the arbitration provision.” The statement has to be sent to Lockbox 6112, P.O. Box 7247, Philadelphia, PA 19170-6112, along with your name, and the email and mailing addresses associated with your account.

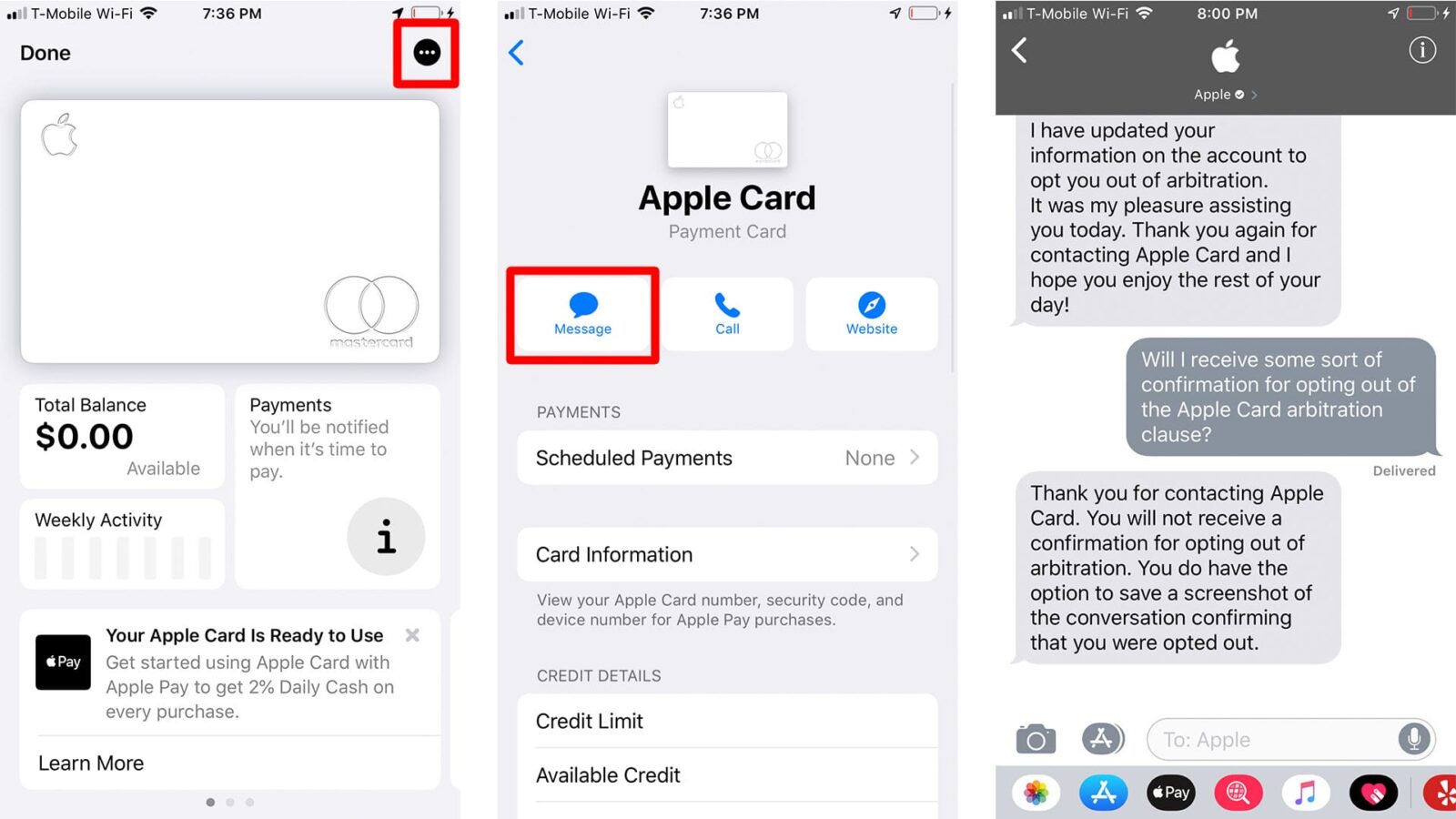

You can also use Messages to state that you opt out of the provision.

- Open the Wallet app on your iPhone.

- Select your Apple Card.

- Tap the three dots in the upper right corner of your screen.

- Tap Message.

- Send a message that says you are opting out of the arbitration clause.

- Wait for a Goldman Sachs representative to process your request.

As of today, you will not receive an official confirmation and acceptance of your statement if you opt out via Messages. Instead, the customer service representative on the other end will instruct you to take a screenshot of your conversation as a form of confirmation.

If you’re looking for ways to use your new Apple Card, check out our list of the best smart home devices for beginners.